ONBOARDING_NEW.ME|shubhangi

This is about rapidly emerging fast fashion brand

NEWME

Hello, newme.asia is a young but rapidly emerging e-commerce platform primarily targeting GenZ women of India and south Asia. Few things about the product.

- Trendy and Diverse Styles: They offer a vast collection of over 200+ new looks every day, catering to various styles and aesthetics, from Barbie core and goddess vibes to timeless black, bohemian flair, and party essentials. They also have sections for athleisure wear, basic staples, and trendy pieces.

- Fast and Affordable: NewMe Asia prides itself on being a "freshest fashion fastest" platform, adding over 1000 new designs every week. They also prioritize affordability, making fashion accessible to a wider audience through competitive pricing and Cash on Delivery (COD) options.

- Engaging App and Website: Their user-friendly app and website are designed for a seamless shopping experience. They offer exciting daily deals, live consultations with fashion stylists, and an extensive fashion campus ambassador program. 👗 🛍️ 👖

This was a brief overview, but NewMe took up my interest because it is killing the market with its trendy pieces and that too at extremely competitive prices.

ICP

ICP 1 | |

Demography | |

Age | 19 |

Gender | Woman |

City | Tier- 3, Raigarh |

Salary | Student |

Education | In college |

Marriage | Nil |

Job Title | Nil |

Interest | -Watch TV shows, Netflix and Instagram, Genz trend follower, Rebel and want to try something new everytime |

Aspirational brand | Zara, Bershka, Shein |

Value Time or Money | Value money over time. |

Responsibility of User | Student |

Source of Money | Parents |

Family Income | <10L Annual Salary |

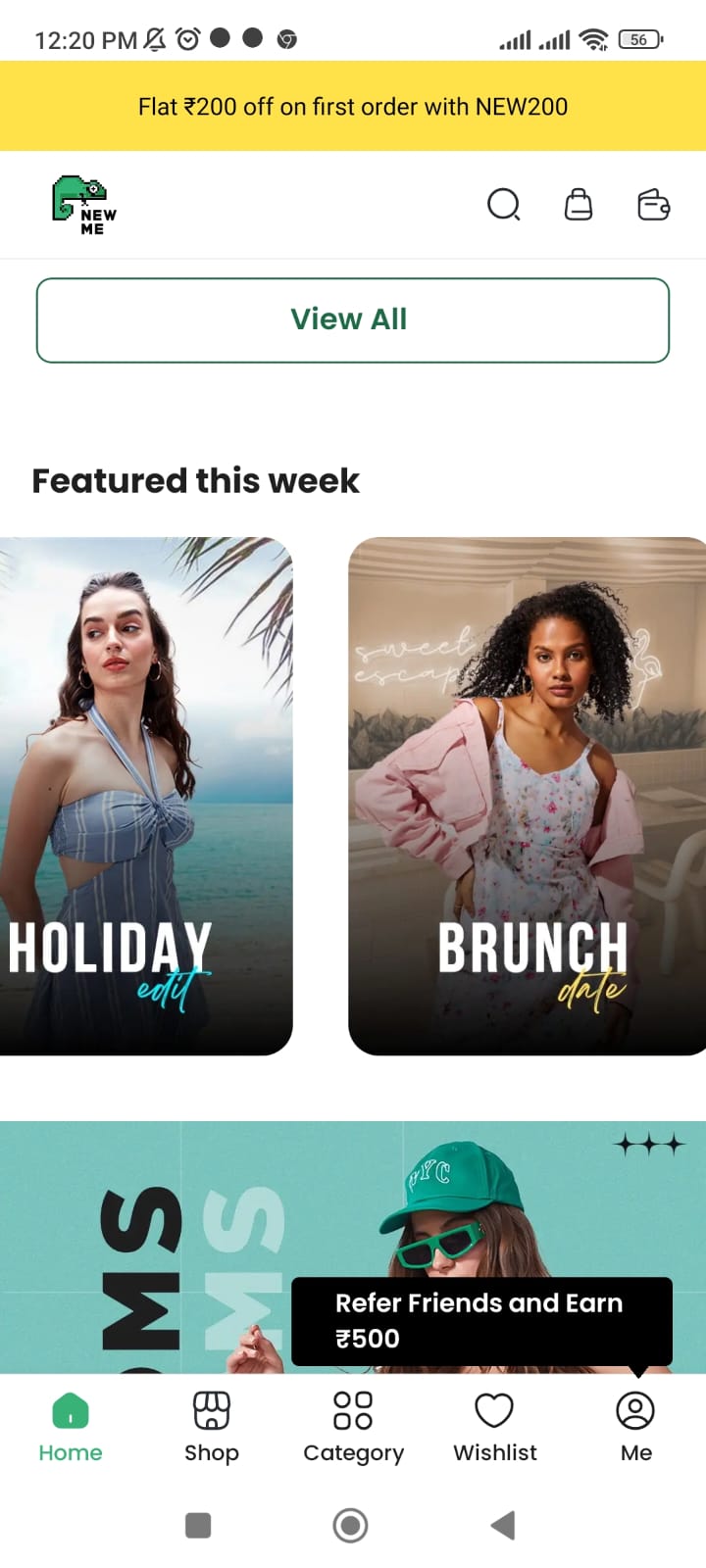

Most used feature of product how much money willing to spend | Featured this Week, Drops every week. Drives excitement and adrenaline rush to user |

How much money willing to spend | 300-600 |

Buying Frequency | 4-5 products per month, Rs 2500 |

ICP 2 | |

Demography | |

Age | 25 |

Gender | Woman |

City | Tier 1, Mumbai |

Salary | 40k per month |

Education | Bachelors |

Marriage | Nil |

Job Title | Associate level |

Interest | -Watch TV shows, Netflix and Instagram, Genz trend follower, Rebel and want to try something new everytime-Party lovers |

Aspirational brand | Zara, H&M, Cider |

Value Time or Money | Value money over time. |

Responsibility of User | New in Job. Minor responsibility |

Source of Money | Own salary |

Family Income | 10-15 Annual Salary |

Most used feature of product how much money willing to spend | Curated collection-1. Deepika Padukone inspired collection2. Valentine collection |

How much money willing to spend | 700-1200 |

Buying Frequency | 4-5 products per month, Rs 5000 |

USER GOALs and JTBD

Primary goal: Social

WHY?

After talking to few users, especially fashion enthusiasts GenZ girls I got to understand a few things:

Their end goal:

The user is of mindset who follows fashion and since fast fashion changes every month and one piece won't be trendy and relatable after 3 months, then investing Rs.3000 on an H&M dress has very low RoI for them. Therefore, the user does affordable fast fashion with primary goal to look chique in her social circle. Look more relatable, become acceptable, use the product few times and thus keep buying new ones.

For e.g. a Zudio T-shirt priced at Rs.499 cannot be used more than 10 times, it wears off pretty quickly either by colour bleeding or fabric not being able to retain its quality after 3-4 washes. But are dirt cheap with depth and breadth in designs.

Secondary goal: Personal

WHY?

As per psychology too, looks create a bias generally at subconscious levels. People interested in fashion are conscious of not just how others dress but also themselves. It is well documented thing. (Ref. https://sites.psu.edu/aspsy/2022/11/10/do-looks-matter-3/)

Few points from above article:

- Attractive people are considered positively; they are found to have wider social appeal, interpersonal and occupational competence, or adjustment, purely based on their physical looks, than unattractive people (Langlois et al., 2000)

2. Researchers at the University of Minnesota, did an experiment in a college prom and found that the only factor that predicted whether a student wanted to see his or her date again was the partner’s physical attractiveness, not their similarities, the quality of their conversation, or the respondent’s level of self-esteem.

- Better attention

- Acceptability in their groups

- Instant gratification after shopping

- Compliments

All of the above, internally boosts the confidence and feel good factor creating a dopamine kick and keeps the person to stay in the loop. This is a classic example of carrot and stick. The ever quickly changing fashion acts as a stick, affordable clothing being carrot.

Tertiary goal: Financial

WHY?

It might seem as these people save money by shopping fast fashion but that is not the case. They rather end up spending more. However, case in point is, if they have a spending appetite of Rs.10,000 they can buy hardly 4-5 bottom wear from ZARA but 10-12 bottom wear from brand like NewMe. Obviously, one will prefer NewMe over ZARA if they are into fast fashion. (Saving money psychologically !! 😉 )

ONBOARDING TEARDOWN

NewMe onboarding.pdf

Few more suggestions:

- Trust factor missing: Being a very young brand which is rapidly emerging, a trust factor could have been added on the home screen. For eg 10,000 satisfied customers.

- Review: They add review but adding how many rated it will give more clarity to refined shoppers. For eg they don't just want to know a product is 4.7 star rated, they want to know X number of customers rated it 4.7 star. This is already done by Myntra, Amazon

- Relatability: At times, the app gives a very foreign feel. It could be made more suited to Indian palette.

- Offers/discounts: These were not nicely captured, thus lowering FOMO factor.

- Collection page sorting changes every few minutes, depicting true essence of fast fashion. For eg while i was on a product, the sort changed quickly showing me more and more products in least possible time.

Some more detail about NEWME.ASIA

Few news articles:

https://restofworld.org/2023/3-minutes-with-sumit-jasoria/

https://www.medianews4u.com/newme-feeds-girls-fashion-obsession-with-sanjana-sanghi/

SUMMARY

- NewMe has started offline stores, first in Mumbai. 12 more are in pipeline for pan India.

- $5.4 million raised recently in seed funding.

- Targets 500 Mn GenZ customers from India and SE Asia

- 70% orders from non-metro cities (WOW)

- 35% manufacture in Mumbai, the rest outsourced from China

- AOV online Rs. 1500, AOV offline Rs. 2500

- it is viewed as Shien's replacement in the country

- Concern of CEO, Indian warehouses wanting minimum order quantity(MOQ) to be at least 500 but these platforms want 10-20 pieces!!! Thus supply chain issue persists. This gap is plugged by China

Keep replenishing the market with newest trends with less than 50 pieces and keep this loop on!! Keeps up the FOMO alive with ever more new products 🤯(brilliant 💡)

NEWME does aggressive PR, deep discounts, big visions! 🚀

AHA Moment

- Amazing buying aesthetics (Look at the denim on denim model, the light blue background)

- Killer sorting: As per occasion (eg holiday, brunch), as per categories for eg bottoms, tops, denims.

- Celeb collection are hottest and most viral internet stuffs, they are also well captured.

ACTIVATION METRIC

What is core value prop here?

Buying hot trends at cheapest rates.

Thus AM could be what percentage of user visiting the platform ( both website and app as website has poor retention) is actually converted on the same day.

For Website-

Qty sold/No of Session visited

For App-

% of user did first purchase within 7 days of installing the app

Retention Metrics

M0 | M1 | M2 | M3 | |

M0 | 100 | 40 | 20 | 10 |

M1 | 200 | 80 | 40 | 20 |

M2 | 300 | 120 | 60 | 30 |

M3 | 400 | 160 | 80 |

Retention Metric should be

M1 Retention rate

M3 Retention rate

M12 Retention rate

% of user purchased within X month of first puchase

For NewMe , took it as benchmark

M1- 40%

M3- 70% [Currently, M3 retention rate of NewMe is 50%]

M12- 100%

Engagement Metric

- DAU/MAU ~ >15% (good for fashion industry)

- Time in a session- ideal shoulkd be minimum 3 minutes

- Depth per session (no of screen changed in a session)- 6-7

- Bounce rate- <30%

Pricing Metric

ASP

AOV

Unit per Order

AOV/ASP

Thanks!

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.